Introduction

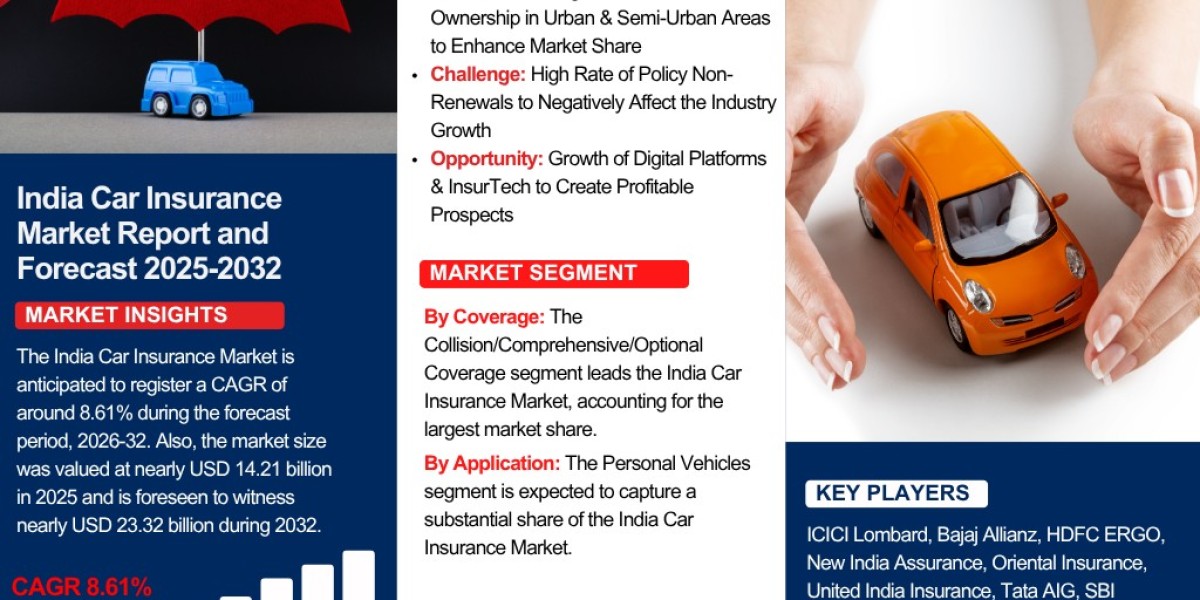

The Indian car insurance market Size is on a steady growth trajectory, driven by rising vehicle ownership, regulatory mandates, and increasing awareness about financial protection. According to Report Cube, the market is anticipated to register a CAGR of around 8.61% between 2026 and 2032. In 2025, the market was valued at nearly USD 14.21 billion and is projected to reach USD 23.32 billion by 2032.

With India’s expanding middle class, urbanization, and digital transformation, the demand for car insurance is expected to surge. However, challenges such as fraud, price sensitivity, and low penetration in rural areas persist. This article explores the key drivers, restraints, and future opportunities shaping India’s car insurance market.

Key Drivers of Growth

- Rising Vehicle Ownership

India’s automobile sector is booming, with increasing sales of both new and used cars. As more individuals and businesses purchase vehicles, the need for mandatory third-party liability insurance (under the Motor Vehicles Act) and comprehensive coverage grows.

- Government Regulations & Mandatory Insurance

The Indian government mandates third-party insurance for all vehicles, ensuring basic financial protection against accidents. Additionally, regulatory reforms by the Insurance Regulatory and Development Authority of India (IRDAI) promote transparency and consumer-friendly policies, encouraging more people to opt for coverage.

- Digital Transformation & InsurTech

The rise of InsurTech (insurance technology) has revolutionized the sector. Companies now offer:

- Instant policy purchases via mobile apps

- Usage-based insurance (UBI) with telematics

- AI-driven claim settlements for faster processing

Digital platforms like Policybazaar, Acko, and Digit have simplified policy comparisons and purchases, attracting tech-savvy consumers.

- Increasing Awareness of Financial Protection

Consumers are becoming more aware of the risks associated with uninsured vehicles, including hefty repair costs and legal liabilities. This shift in mindset is driving demand for comprehensive insurance beyond just third-party coverage.

Challenges & Restraints

Despite strong growth prospects, the Indian car insurance market faces several hurdles:

- Fraud & False Claims

Insurance fraud, including staged accidents and exaggerated claims, remains a major concern. This increases costs for insurers, leading to higher premiums for honest customers.

- Price Sensitivity Among Consumers

Many Indian buyers prioritize affordability over coverage benefits, opting for the cheapest third-party policies instead of comprehensive plans. This limits market profitability for insurers.

- Low Penetration in Rural Areas

While urban regions show strong insurance adoption, rural areas lag due to:

- Limited awareness

- Lack of digital infrastructure

- Lower vehicle ownership

- Intense Competition & Thin Margins

With numerous private and public insurers competing, pricing wars often reduce profit margins. Companies must innovate with add-on covers (zero depreciation, engine protection) to differentiate themselves.

Future Trends & Opportunities

- Growth of Electric Vehicle (EV) Insurance

As India pushes for EV adoption, insurers are developing specialized policies covering battery damage, charging risks, and government subsidies. This niche segment presents a lucrative opportunity for early movers.

- Personalized & Usage-Based Insurance

Telematics and IoT devices enable pay-as-you-drive (PAYD) models, where premiums are based on driving behavior. Safe drivers benefit from lower costs, while insurers gain data-driven insights.

- Expansion of Add-On Covers

Consumers are increasingly opting for riders like:

- Zero depreciation (full claim without deduction)

- Roadside assistance

- Key and lock replacement

These value-added services improve customer retention and profitability.

- Partnerships with Automakers & Fintech Firms

Insurers are collaborating with car manufacturers, banks, and fintech platforms to offer bundled policies at the point of sale. For example, Maruti Suzuki’s partnership with Bajaj Allianz streamlines insurance purchases for new buyers.

Conclusion: Why Stakeholders Should Pay Attention

The Indian car insurance market is poised for robust growth, fueled by regulatory support, digital innovation, and rising vehicle sales. While challenges like fraud and rural penetration persist, emerging trends—such as EV insurance, telematics, and AI-driven claims—present exciting opportunities.

For insurers, investing in technology, customer education, and customized products will be key to capturing market share. Investors can capitalize on the sector’s steady expansion, while consumers benefit from more aff